Setting Up the Taxable Payments Annual Report

Before you can generate the Taxable Payments Annual Report (TPAR), you must first set up the following:

Setting Up Payer Details for TPAR

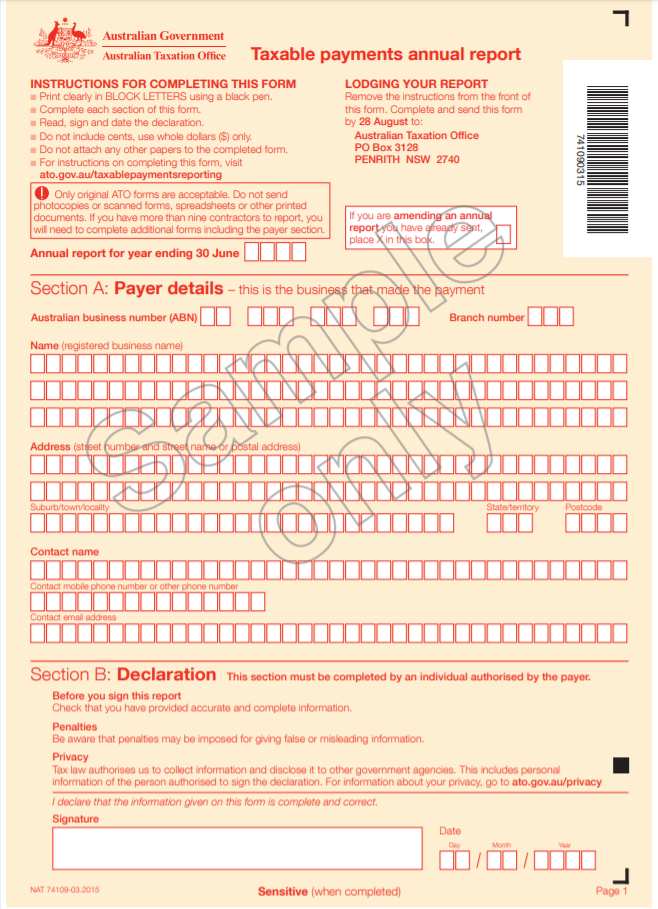

The Payer Details is found on Section A of the Taxable Payments Annual Report. It contains your Australian business information from the Company Information page or Subsidiary record. See TPAR Section A Sample Form.

Before you generate a TPAR, ensure to fill out the following fields on your company or subsidiary record:

-

ABN - Enter your 11-digit Australian Business Number.

If you're using an account with Suitetax, this field isn't applicable for you. For Suitetax accounts, ABN value is sourced directly from the Tax Registrations tab. To generate the report successfully with an ABN value, the entire reporting period must be covered by a single tax registration number from the start to the end of the period.

-

Branch Number - Enter a branch number if you have multiple branches and one ABN. If you don't have a branch number, enter 001.

-

Legal Name - Enter your registered business name.

-

Address - Enter your street or postal address. Write each part of the address separately in the fields provided.

-

Phone - Provide a daytime phone number where ATO can reach you.

-

Contact Name - Provide the name of the person whom the ATO will contact for further information.

-

Contact Email - Provide an email address where the ATO can contact you about your annual report.

For more information about entering company or subsidiary details, see Configuring Company Information or Editing Subsidiary Records help topic.

For more information about generating TPAR, see Enabling ANZ Features

TPAR Section A Sample Form

The following image is a sample form from the ATO.

Setting Up Payee Details for TPAR

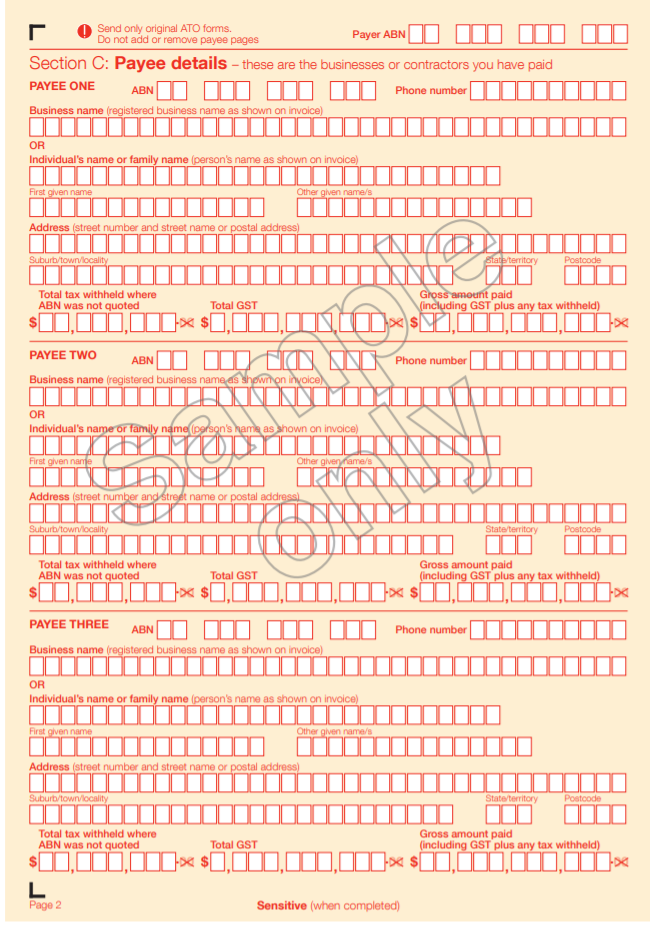

The Payee Details is found on Section C of the Taxable Payments Annual Report. It contains the contractor's business information from the Vendor record. See TPAR Section C Sample Form.

To declare a vendor as a Payee on the TPAR, you must set up the vendor as TPAR Eligible. Afterward, all bills paid to the vendor are automatically reported on the TPAR.

To set up vendor as TPAR eligible:

-

In NetSuite, go to Lists >Relationships > Vendors.

-

Select the vendor that you want to include in the report.

-

Click Edit.

-

On the AUS Reporting subtab, check the TPAR Eligible box.

For OneWorld accounts, the AUS Reporting subtab only appears after you select the vendor's Australian subsidiary from the Primary Subsidiary list.

-

Fill out the following fields:

-

If the vendor provided an Australian Business Number (ABN), go to the Financial subtab and enter the 11-digit ABN on the Tax Registration Number field.

Note:If a vendor provides a new ABN, you must create a new vendor record. Bills and bill payments where you quoted the new ABN are reported on a separate Payee Details on the TPAR.

-

(Optional) In the Primary Information field group, select a category from the Category list.

If the vendor's a government entity, select Government Entity. If the vendor is a government entity but exempted from TPAR, select Government Exempt.

-

-

Click Save.

For more information about adding vendor record details, see Creating a Vendor Record.

If you're declaring multiple vendors, you can perform a Mass Update to check the TPAR Eligible boxes. For more information, see Mass Updating Vendor Records and Transactions for TPAR Reporting.

Existing bills and bill payments of a newly set TPAR Eligible vendor aren't automatically reported in the TPAR. You must manually update these transactions to include it in the report. For more information, see Declaring Vendor Bills and Bill Payments Reportable for TPAR.

TPAR Section C Sample Form

The following image is a sample form from the ATO.

Declaring Vendor Bills and Bill Payments Reportable for TPAR

If you have existing reportable vendor bills and bill payments prior to setting the vendor as TPAR Eligible, you must manually go through each transaction and check the Include in TPAR box to include it in the TPAR. For the complete instruction, see Including Bill Payments in TPAR. You can also perform a mass update of your transactions to include it in the report. For more information, see Mass Updating Vendor Records and Transactions for TPAR Reporting.

To learn more about reporting bills, bill payments, and bills paid through grants in TPAR, see Reporting Vendor Bills and Bill Payments on TPAR.

Related Topics

- Reporting Vendor Bills and Bill Payments on TPAR

- Viewing the TPAR Summary Report

- Viewing the TPAR Detailed Report

- Taxable Payments Annual Report

- GST on Sales Summary Report

- GST on Sales Detail Report

- GST on Purchases Summary Report

- GST on Purchases Detail Report

- Viewing Australian Goods and Services Tax (GST) Reports

- Setting Tax Preferences for Australia

- Creating Tax Codes - Australia

- Australia Tax Codes

- Using Wine Equalization Tax (WET)

- Accounting for Goods and Services Tax (GST) - Australia

- Setting Up Your Business Activity Statement

- Australia Tax Topics

- Australia Payment Formats

- Shipping Integration with Australia Post

- Setting Up Australia-specific Preferences

- Australia Account Setup