Surcharge Rules

Surcharge rules put an additional charge on the base premium amount during a premium calculation. Like adjustment rules, which surcharge rules are applied depends on the specified conditions and it is possible to have multiple surcharge rules evaluated and applied in the same calculation.

Surcharge rules are universal configuration rules that do not have to be attached to an enrollment product or group account in order to apply; they are always evaluated, even-though they may only apply under specific circumstances, for example, like a surcharge depending on where the insured person or object is registered.

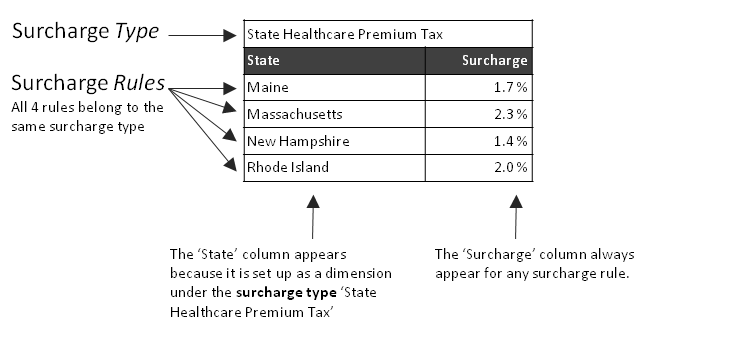

Like premium schedules and adjustment rules, surcharge rules can be seen as look-up tables, where each column represents a condition that has to be met, and the last column represents the surcharge amount or percentage that applies if all specified conditions are met.

It is possible to have more than one kind of surcharge, applying to the same calculation. For example, there may be a regional tax percentage that varies per area that stacks with a fixed national tax percentage. In this example, the national and regional taxes are configured in the application as two separate surcharge types.

A single surcharge type can have many surcharge rules. For example, for the regional tax mentioned earlier, they may be a different percentage associated with each area. There would be a surcharge rule for each area.

No more than one surcharge rule is applied per surcharge type. If more than one surcharge rule for the surcharge type would apply, then the application gives a warning message during the calculation.

Setting Up Surcharge Types

Surcharge types are in fact Schedule Definitions of the type surcharge. A schedule definition specifies which columns (called dimensions) appear for its surcharge rules. It also connects the values in those columns to the values on the person or object or the policy, so that the application knows how to evaluate the surcharge rules during the premium calculation. For the example in the image above, that means connecting (comparing) the state on the surcharge rule to the state of the insured person’s current living address.

The surcharge type also defines on which amount the calculation is based: either on the base premium or on the base premium after deduction or inclusion of all the adjustments. On the surcharge type it is also specified if the surcharge will be distributed across the applicable components, for example when the value-added tax has to be distributed across the product premium and an administrative fee. In addition, the surcharge type also specifies if the surcharge is considered (or not) as an input to compute the base amount on which the percentage commission is applied.

All surcharge schedule definitions appear as surcharge types in the surcharge page.

Setting Up Surcharge Rules

In the surcharge page, the user has to select one of the available surcharge types and time periods, before he or she can add a new surcharge rule. The columns that are available on a surcharge rule depend on the schedule definition, i.e., surcharge type, on which the rule is based. A surcharge rule has a default column that specifies the actual surcharge value. The presence of any other column depends on the surcharge type:

| Surcharge Rule | |

|---|---|

Column Name |

Description |

All columns as specified under the Surcharge Type |

|

Surcharge |

The amount, percentage or dynamic logic function by which the premium is surcharged and the value type (specifies if the surcharge is an amount or percentage; if it is an amount the user has to select the applicable currency) |

The surcharge value is always added to the premium amount. It is possible to specify a negative surcharge value. This results in reduction of the premium, rather than an additional charge. The value type specifies if the surcharge value is interpreted as an absolute amount, as a percentage or calculated by a dynamic logic function.

Dynamic logic functions come in two flavors, they either prorate the result of the dynamic logic function in case of partial calculation periods, or they do not.

It is possible to set up multiple surcharge rules for the same type having different amount currencies; so it is not needed to set up different surcharge types for different currencies.

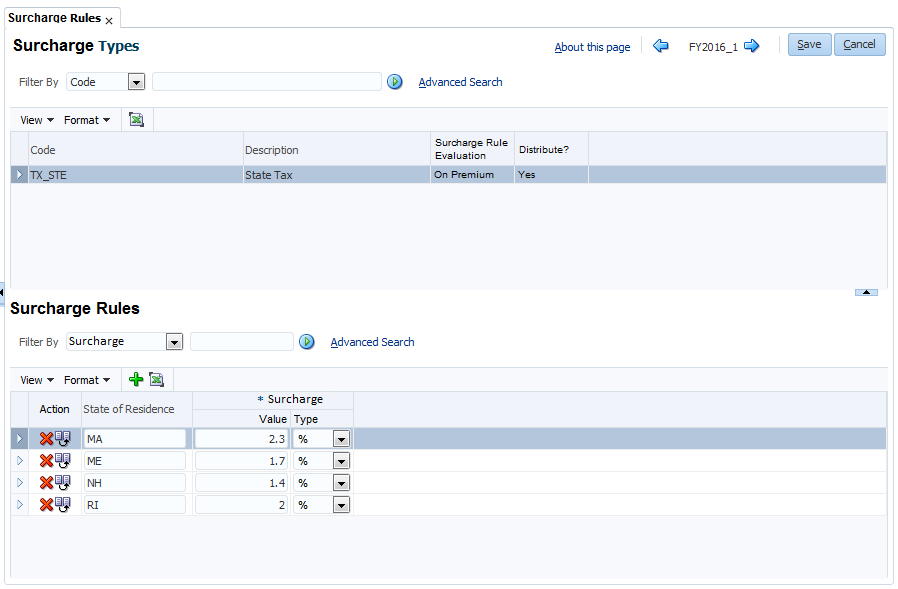

Note that in the mock-up below the State of Residence field is configured as an additional dimension.

Example Configuration

This example shows the configuration for a basic surcharge rule that applies a surcharge on the base premium, depending on where the person or object is registered.

In this example, we set up a schedule definition that includes additional logic to evaluate the state on a person’s living address. The logic in this example is rather simple, but this feature can also be used for more complex, custom evaluations for surcharge rules.

The first step is to set up the time period that governs the 'condition' columns on the surcharge rule. In this example there is only the condition on the member’s state of residence.

| Time Period | ||

|---|---|---|

Name |

Start |

End |

Calendar year 2015 |

01-01-2015 |

12-31-2015 |

More time periods can be set up later, e.g., when we want to specify that from calendar year 2016 going forward other states will be included in the surcharge schedule that were not included before.

The second step is to set up the logic that compares the person’s country region to the values in the surcharge rule.

| Dynamic Logic Condition | |

|---|---|

Code |

Logic |

EVALUATE STATE |

return person.addressList.asOf(lookUpDate).countryRegion .code = surchargeRule.state |

The next step is to set up a schedule definition. The schedule definition controls which columns the surcharge rule shows in addition to the columns for the value and value type. We add a single column (dimension) for the state of residence. The dimension name has to be the same as the name we used in the dynamic logic condition, i.e., surchargeRule.state.

| Schedule Definition | |||||

|---|---|---|---|---|---|

Code |

Description |

Type |

Surcharge Rule Evaluation |

Distribute? |

Line/Rule Evaluation Condition |

TX_STE |

State Tax |

Surcharge |

On Premium |

Y |

EVALUATE STATE |

| Schedule Dimensions | |||||

|---|---|---|---|---|---|

Header |

Name |

Type |

Parameter |

Dyn Field |

Usage |

State of Residence |

state |

Generic |

- |

- |

Value |

Now that the schedule definition has been created, a new surcharge type has become available in the surcharge page. The next step is to set up surcharge rules the new type.

| Surcharge Type | |

|---|---|

Code |

Description |

TX_STE |

State Tax |

| Surcharge Rules | |

|---|---|

State of Residence |

Surcharge |

ME |

1.7 % |

MA |

2.3 % |

NH |

1.4 % |

RI |

2.0 % |

The surcharge rule configuration is now complete. All surcharge rules are evaluated by default for any calculation.