Considering Pass Through Charges While Calculating Original Revenue

The system considers the recurring and non-recurring pass through charges of an account while calculating the original revenue of the account and customer in a deal. It also considers the recurring and non-recurring pass through charges which are generated through the Transaction Aggregation process (in the Transaction Feed Management (TFM) module). The system does the following while deriving the recurring and non-recurring pass through charges of an account:

-

Derives the usage period (i.e. usage start date and usage end date) using the price selection date specified in the deal

-

Considers those billable charges with the pass through amount where the usage start or end date falls within the billable charge start and end dates

-

Calculates the pass through charges for the usage period in the deal frequency

-

Converts the pass through charges in the account's invoice currency and deal currency when the pass through charges are in the different currency

You can view the pass through charges of a price item which are billed to the account in the Pass Through Charge Information section of the Pricing and Commitments screen. The system enables you to derive the pass through charges of an account in either of the following mode:

-

Online Mode - If you set the Refer Volume Aggregation option type of the C1-DEAL feature configuration to N, the system derives the recurring and non-recurring pass through charges of an account in the online mode. The online mode means that the pass through charges of an account are derived for the usage period in the deal frequency at the runtime when you view the pricing and commitment details of the account.

-

Deferred Mode - If you set the Refer Volume Aggregation option type of the C1-DEAL feature configuration to Y, the system derives the recurring and non-recurring pass through charges of an account in the deferred mode (i.e. in the background). The deferred mode means when you execute the following batches:

-

Aggregate Account's Volume and Count (PREAGGR) - The Aggregate Account's Volume and Count (PREAGGR) batch derives the recurring and non-recurring pass through charges of an account for all deal frequencies (i.e. Monthly, Quarterly, Half Annually, and Annually) and stores the information in the C1_CHARGE_AGGR table. If you want to derive the pass through charges of an account in the deferred mode, you need to execute the Aggregate Account's Volume and Count (PREAGGR) batch before creating a deal for an existing account. For more information about the batch, refer to Oracle Revenue Management and Billing Batch Guide.

-

Aggregate Customer's Volume and Count (CSTPREAG) - The Aggregate Customer's Volume and Count (CSTPREAG) batch aggregates the pass through charges of all accounts of a customer for all deal frequencies (i.e. Monthly, Quarterly, Half Annually, and Annually) and stores the information in the C1_CHARGE_AGGR table. If you want to aggregate the pass through charges of all accounts of a customer in the deferred mode, you need to execute the Aggregate Customer's Volume and Count (CSTPREAG) batch after executing the Aggregate Account's Volume and Count (PREAGGR) batch. For more information about these batches, refer to Oracle Revenue Management and Billing Batch Guide.

The system then extracts the pass through charges of an account from the C1_CHARGE_AGGR table while creating a deal. We recommend you to use this mode to experience a better system performance.

-

Recurring Pass Through Charge Calculation

Let us understand how the recurring pass through charges are calculated for a usage period in a deal frequency.

Example 1:

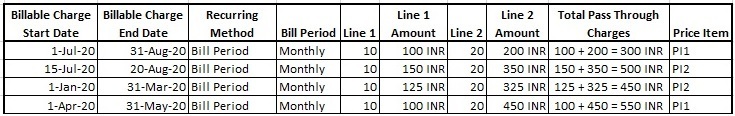

A deal is created for an account named A1 where the deal start date is set to 01-Jul-2020, deal end date is set to 31-Aug-2020, deal currency is set to USD, price selection date is set to 01-Aug-2020, usage period is set to Monthly, and deal frequency is set to Quarterly. Let us assume that the following recurring pass through charges exists for the A1 account where the invoice currency is set to INR:

Now, while calculating the original revenue, the system derives the recurring pass through charges for the usage period in the deal frequency. To derive the recurring pass through charges for the usage period in the deal frequency, the system does the following:

-

Derives the usage period (i.e. usage start date and usage end date) using the price selection date and usage frequency in the following manner:

Price Selection Date = 01-Aug-2020 Usage End Date = Price Selection Date = 01-Aug-2020 Usage Start Date = Usage End Date - Usage Frequency = 01-Aug-2020 - 1 Month (i.e. 30 days) = 02-Jul-2020 Usage Period = 02-Jul-2020 to 01-Aug-2020 -

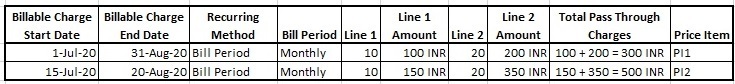

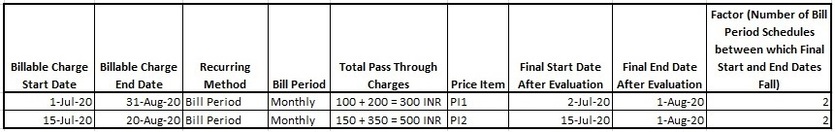

Considers those recurring billable charges with the pass through amount where the usage start or end date falls within the billable charge start and end dates. For example, the system considers the following recurring billable charges of the A1 account:

-

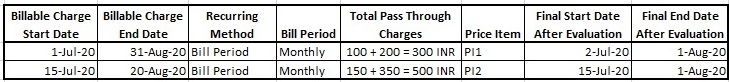

Derives the final start and end dates for the selected billable charges in the following manner:

Final Start Date = Billable Charge Start Date or Usage Period Start Date whichever is later Final End Date = Billable Charge End Date or Usage Period End Date whichever is earlierThe following table indicates the final start and end dates for the selected billable charges:

-

Derives the factor using the final start and end dates and recurring method in the following manner:

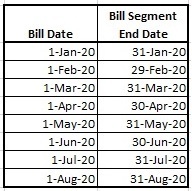

Let us assume that the Monthly bill period contains the following schedules:

In such case, the system will derive the factor using the bill period in the following manner:

-

Multiplies the total pass through charges with the factor, and thereby derives the final pass through charges in the following manner:

Total Recurring Pass Through Charges of PI1 = (300*2) = 600 INR Total Recurring Pass Through Charges of PI2 = (500*2) = 1000 INR -

Calculates the pass through charges for the usage period in the deal frequency in the following manner:

Recurring Pass Through Charges of PI1 for the Usage Period in the Deal Frequency = (Total Recurring Pass Through Charges of PI1 * Deal Frequency)/Usage Period = (600*3 (i.e. Quarterly))/1(i.e. Monthly) = 1800 INR Recurring Pass Through Charges of PI2 for the Usage Period in the Deal Frequency = (Total Recurring Pass Through Charges of PI2 * Deal Frequency)/Usage Period = (1000*3 (i.e. Quarterly))/1(i.e. Monthly) = 3000 INR -

Converts the pass through charges in the deal currency (i.e. USD) using the available exchange rate (for example, 0.013):

Recurring Pass Through Charges of PI1 in USD = 1800*0.013 = 23.4 USD Recurring Pass Through Charges of PI2 in USD = 3000*0.013 = 39 USD

In this way, the system calculates and derives the recurring pass through charges for the A1 account in the D1 deal.

Example 2:

A deal is created for an account named A2 where the deal start date is set to 01-Jan-2020, deal end date is set to 28-Feb-2020, deal currency is set to USD, price selection date is set to 20-Jan-2020, usage period is set to Annually, and deal frequency is set to Quarterly. Let us assume that the following recurring pass through charges exists for the A2 account where the invoice currency is set to EURO:

Now, while calculating the original revenue, the system derives the recurring pass through charges for the usage period in the deal frequency. To derive the recurring pass through charges for the usage period in the deal frequency, the system does the following:

-

Derives the usage period (i.e. usage start date and usage end date) using the price selection date and usage frequency in the following manner:

Price Selection Date = 20-Jan-2020 Usage End Date = Price Selection Date = 20-Jan-2020 Usage Start Date = Usage End Date - Usage Frequency = 20-Jan-2020 - 1 Year (i.e. Annually)= 21-Jan-2019 Usage Period = 21-Jan-2019 to 20-Jan-2020 -

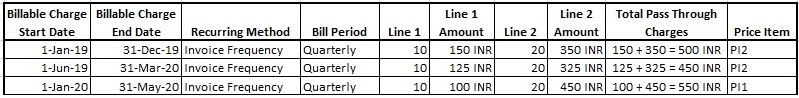

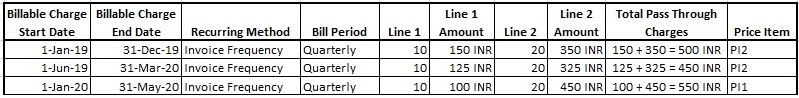

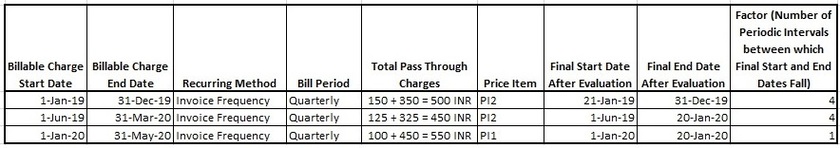

Considers those recurring billable charges with the pass through amount where the usage start or end date falls within the billable charge start and end dates. For example, the system considers the following recurring billable charges of the A2 account:

-

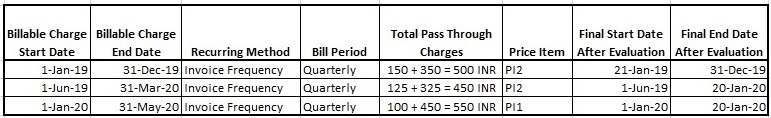

Derives the final start and end dates for the selected billable charges in the following manner:

Final Start Date = Billable Charge Start Date or Usage Period Start Date whichever is later Final End Date = Billable Charge End Date or Usage Period End Date whichever is earlierThe following table indicates the final start and end dates for the selected billable charges:

-

Derives the factor using the final start and end dates and recurring method in the following manner:

Let us assume that the Quarterly invoice frequency contains the following periodic intervals:

In such case, the system will derive the factor using the invoice frequency in the following manner:

-

Multiplies the total pass through charges with the factor, and thereby derives the final pass through charges in the following manner:

Total Recurring Pass Through Charges of PI1 = (550*1) = 550 INR Total Recurring Pass Through Charges of PI2 = (500*4)+(450*4) = 2000+1800 = 3800 INR -

Calculates the pass through charges for the usage period in the deal frequency in the following manner:

Recurring Pass Through Charges of PI1 for the Usage Period in the Deal Frequency = (Total Recurring Pass Through Charges of PI1 * Deal Frequency)/Usage Period = (550 * 3 (i.e. Quarterly))/12(i.e. Annually) = (1650/12) = 137.5 INR Recurring Pass Through Charges of PI2 for the Usage Period in the Deal Frequency = (Total Recurring Pass Through Charges of PI2 * Deal Frequency)/Usage Period = (3800 * 3 (i.e. Quarterly))/12(i.e. Annually) = (11400/12) = 950 INR -

Converts the pass through charges in the account's invoice currency (i.e. EURO) and deal currency (i.e. USD) using the available exchange rates:

For example, to convert the pass through charges in the account's invoice currency, the exchange rate from INR to USD is 0.013:

Recurring Pass Through Charges of PI1 in USD = 137.5*0.013 = 1.79 USD Recurring Pass Through Charges of PI2 in USD = 950*0.013 = 12.35 USDFor example, to convert the pass through charges in the deal currency, the exchange rate from INR to EURO is 0.012:

Recurring Pass Through Charges of PI1 in EURO = 137.5*0.012 = 1.65 EURO Recurring Pass Through Charges of PI2 in EURO = 950*0.012 = 11.4 EURO

In this way, the system calculates and derives the recurring pass through charges for the A2 account in the D1 deal.

Non-Recurring Pass Through Charge Calculation

Let us understand how the non-recurring pass through charges are calculated for a usage period in a deal frequency.

Example 3:

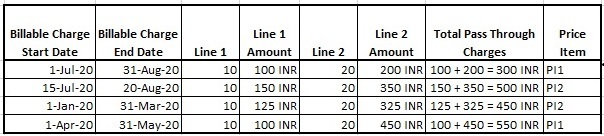

A deal is created for an account named A1 where the deal start date is set to 01-Jul-2020, deal end date is set to 31-Aug-2020, deal currency is set to USD, price selection date is set to 01-Aug-2020, usage period is set to Monthly, and deal frequency is set to Quarterly. Let us assume that the following non-recurring pass through charges exists for the A1 account where the invoice currency is set to INR:

Now, while calculating the original revenue, the system derives the non-recurring pass through charges for the usage period in the deal frequency. To derive the non-recurring pass through charges for the usage period in the deal frequency, the system does the following:

-

Derives the usage period (i.e. usage start date and usage end date) using the price selection date and usage frequency in the following manner:

Price Selection Date = 01-Aug-2020 Usage End Date = Price Selection Date = 01-Aug-2020 Usage Start Date = Usage End Date - Usage Frequency = 01-Aug-2020 - 1 Month (i.e. 30 days) = 02-Jul-2020 Usage Period = 02-Jul-2020 to 01-Aug-2020 -

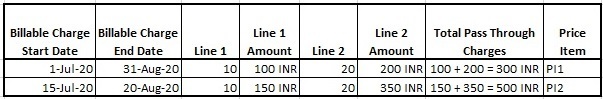

Considers those non-recurring billable charges with the pass through amount where the usage start or end date falls within the billable charge start and end dates. For example, the system considers the following non-recurring billable charges of the A1 account:

-

Derives the former start date and latter end date of the billable charges in the following manner:

Former Start Date = Compare the Start Dates of All Billable Charges and Reterive the Earliest Start Date Latter End Date = Compare the End Dates of All Billable Charges and Reterive the Latest End DateIn this case, the former start date is 01-Jul-2020 and latter end date is 31-Aug-2020.

-

Derives the number of months between the former start date and latter end date. In this case, the number of months between 01-Jul-2020 and 31-Aug-2020 is 2.

-

Derives the monthly non-recurring pass through charges in the following manner:

Monthly Non-Recurring Pass Through Charges of PI1 = Total Non-Recurring Pass Through Charges of PI1/Number of Months between Former Start and Latter End Dates = 300/2 = 150 INR Monthly Non-Recurring Pass Through Charges of PI2 = Total Non-Recurring Pass Through Charges of PI2/Number of Months between Former Start and Latter End Dates = 500/2 = 250 INR -

Calculates the non-recurring pass through charges for the usage period in the deal frequency in the following manner:

Non-Recurring Pass Through Charges of PI1 for the Usage Period in the Deal Frequency = (Monthly Non-Recurring Pass Through Charges * Deal Frequency)/Usage Frequency =(150 * 3 (i.e. Quarterly))/1(i.e. Monthly) = (450/1) = 450 INR Non-Recurring Pass Through Charges of PI2 for the Usage Period in the Deal Frequency = (Monthly Non-Recurring Pass Through Charges * Deal Frequency)/Usage Frequency =(250 * 3 (i.e. Quarterly))/1(i.e. Monthly) = (750/1) = 750 INR -

Converts the pass through charges in the deal currency (i.e. USD) using the available exchange rate (for example, 0.013):

Non-Recurring Pass Through Charges of PI1 in USD = 450*0.013 = 5.85 USD Non-Recurring Pass Through Charges of PI2 in USD = 750*0.013 = 9.75 USD

In this way, the system calculates and derives the non-recurring pass through charges for the A1 account in the D1 deal.