Calculation Period Based

This method of calculation for premiums, adjustments and applies when the amount configuration is for a calculation period. The system considers the amount for a calculation period when the amount interpretation setting on the premium schedule is 'Calculation Period'. In this method, the calculations are contained within the calculation period and that’s why the calculations over a period of time are never looked upon to determine any reconciliations.

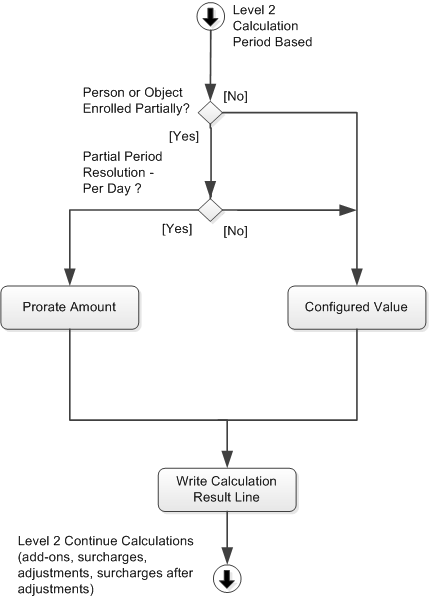

The calculation logic for determining the amount is as described in the image below:

| Circumstances | Calculations |

|---|---|

Full Enrollment |

Configured Value |

Partial Enrollment - Partial Period Resolution Full Charge |

Configured Value |

Partial Enrollment - Partial Period Resolution Per Day |

Configured Value * # Enrolled Days/# Calculation Period Days |

Partial Enrollment - Partial Period Resolution No Charge |

No calculations |

The first step is to determine whether the policy enrollment is full or partial. For this, the system takes into account the overlap in time validity of the policy enrollment with the calculation period.

In case of the enrollment product premium, adjustment and surcharge calculations, the system checks if the policy enrollment product is fully or partially enrolled for the calculation period. Fully enrolled implies that the policy enrollment product is present for all the days in the calculation period for the calculation period segment in context.

In case of the add-on premium, the system checks if the policy add-on is fully or partially enrolled over the calculation period. This is because the add-ons have their own time validity.

Partial Period Resolution

The calculation for policy enrollment products that are only effective during part of the calculation period can be handled one of three ways.

Which way, depends on a setting on the enrollment product record.

-

No Charge means zero premium amount is charged for partial periods. In this scenario the calculation for the policy enrollment product is complete, as there is no premium to calculate.

-

Full Charge means the premium is calculated as if the person or object was enrolled on the product for the full calculation period to which the calculation period segment in context belongs. The premium calculation continues with this assumption.

-

Per Day means the system charges premium (and surcharges, and adjustments) only for the days that the person or object is enrolled. The system reduces the calculation results based on the number of days the person or object was enrolled, divided by the number of days over which the premium amount applies.

-

Enrolled Days Threshold means that Full Charge is applied if the enrolled days threshold is met and that No Charge is applied if the enrolled days threshold is not met.

The system charges the configured value if the person or object is 'fully enrolled'. Otherwise, it checks for the partial period resolution setting on the enrollment product. The configured value gets charged for the calculation period segment if the partial period resolution is 'Full Charge' otherwise the configured value is reduced by a prorate factor for the number of days the person or objects is enrolled for but if the partial period resolution is set to 'No Charge' then the calculation process for the calculation period segment ends. The prorating factor is the number of days the person or object is enrolled divided by the number of days in the calculation period segment.

Note that the amount distribution setting is not applicable under this method of calculation.

| Each calculation period below will be identified as a single calculation period segment during the premium calculation process |

Example 1 - Policy with a Contract

Configuration

A policy enrollment for the enrollment product BASIC PLAN exists from 4/1/2015 - 12/11/2015. The contract period is from 1/1/2015 - 31/12/2015. The contract reference date is 1/1/2015.

| Contract Details | |||

|---|---|---|---|

Start Date |

End Date |

Contact Reference Date |

|

1/1/2015 |

31/12/2015 |

1/1/2015 |

|

Enrollment Details |

|||

Policy Enrollment |

Enrollment Product |

Start Date |

End Date |

W.Wright |

BASIC PLAN |

4/1/2015 |

12/11/2015 |

The default time periods are:

| Default Time Periods | ||

|---|---|---|

2015 -1 |

1/1/2015 |

30/6/2015 |

2015- 2 |

1/7/2015 |

31/12/2015 |

The calculation periods are:

| Alias | Start Date | End Date | CP Reference Date |

|---|---|---|---|

Jan'15 |

1/1/2015 |

31/1/2015 |

1/1/2015 |

Feb'15 |

1/2/2015 |

28/2/2015 |

1/2/2015 |

… |

… |

… |

… |

Dec'15 |

1/12/2015 |

31/12/2015 |

1/12/2015 |

The premium schedule lines associated to BASIC PLAN are:

| Premium Schedule Lines | ||||

|---|---|---|---|---|

Default Time Period |

Age From |

Age To |

Gender |

Premium |

2015-1 |

- |

- |

- |

100 |

2015-2 |

- |

- |

- |

120 |

Calculations

The premium calculations for the policy enrollment product for the year 2015 is as below:

| Calculation Period | Premium Amount | Calculation |

|---|---|---|

Jan'15 |

90.32 |

100*(28/31) |

Feb'15 |

100 |

Premium Value |

… |

… |

… |

Oct'15 |

100 |

|

Nov'15 |

40 |

100*(12/30) |

Suppose that the partial period setting on the enrollment product - BASIC PLAN is 'Per Day'. That’s why the segments of Jan and Nov are pro rated to 100*(28/ 31) and 100*(12/30) respectively.

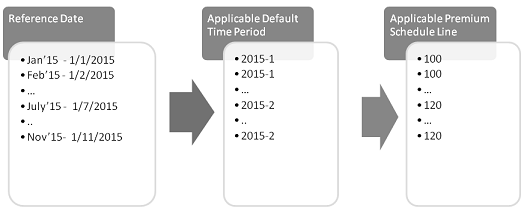

All the calculation periods within the contract period refers the configurations as of the contract reference date. Therefore, the selected default time period that applies for all the calculation periods is 2015-1. The premium amount that applies within the default time period 2015-1 is 100.00.

Example 2 - Policy without a Contract

If the premium configurations are the same as in the above example, then the following premium calculations for the person or object on a policy without a contract period hold true:

| Calculation Period | Premium Amount | Calculation |

|---|---|---|

Jan'15 |

90.32 |

100*(28/31) |

Feb'15 |

100 |

Premium Value for Default Time Period - 2015-1 |

… |

… |

|

June'15 |

100 |

|

July'15 |

120 |

Premium Value for Default Time Period - 2015-2 |

Oct'15 |

120 |

|

… |

… |

|

Nov'15 |

48 |

120*(12/30) |

The change in the charged amount from the calculation period July'15 onwards is because the setting on the calculation periods determines the reference date. In this example, every calculation period has its start date as the reference date and this date is considered as the reference date for evaluation of the configuration.

The premium calculation for the calculation period July'15 selects the default time period as 2015-2 and, therefore, the charged premium amount is 120.00.

Similarly, the applicable premium amounts for the calculation periods of Aug'15 up to Nov'15 is 120.00. The premium for Nov'15 is prorated to 120*(12/30).

Amount Recalculation

In this method, the calculations are contained within the calculation period, therefore, if a calculation period segment is part of the recalculation process, the applicable amount changes only if the new value applies.

Consider a scenario of policy enrollment product termination to understand this.

A policy with a policy enrollment product from 1/1/2015 to 31/12/2015 has an applicable premium of 100 per calculation period. If the collection frequency is set to 12, then the premium calculation batch when executed with the input Calculation Period of Jan'15, will result into the following calculations:

| Calculation Period | Premium |

|---|---|

Jan'15 |

100 |

Feb'15 |

100 |

Mar'15 |

100 |

April'15 |

100 |

May'15 |

100 |

June'15 |

100 |

July'15 |

100 |

Aug'15 |

100 |

Sep'15 |

100 |

Oct'15 |

100 |

Nov'15 |

100 |

Dec'15 |

100 |

However, suppose this policy is terminated on July 5/7/2015, with the policy mutation having an effective date of 1/1/2015.

If the premium calculation batch executes with a look back date of 1/1/2015, then the calculation period Jan'15 onwards up to July'15 will be recalculated. If the applicable premium value of 100.00 per calculation period still holds true, the recalculation will be as

| Calculation Period | Premium |

|---|---|

Jan'15 |

100 |

Feb'15 |

100 |

Mar'15 |

100 |

April'15 |

100 |

May'15 |

100 |

June'15 |

100 |

July'15 |

100*(5/31) = 16.13 |

For the above scenario if the look back date is supposed to be 1/4/2015 and the mutation effective date is 5/7/2015, then only the calculation period of July'15 will be recalculated as

| Calculation Period | Premium |

|---|---|

July'15 |

100*(5/31) = 16.13 |