Contract Period Based

This method of calculation for premiums, adjustments and surcharges is applicable when the amount interpretation of the premium schedule is 'Calendar Year' and there exists a contract on the policy. In this method, the configured amount is applicable for calculation periods that belong to a span of a period - a Year. The number of days that makes up the year is 365, except for contract periods that include the 29th of February in which case the number of days is 366.

If the contract spans exactly a year, that is when the number of days in the contract period are equal to the number of days that makes up the year, the configured amount is taken as the applicable amount for the entire contract period; otherwise the amount is either reduced or extrapolated to derive the applicable amount for the contract period. This method, therefore, requires the system to carry out reconciliation calculations in the last calculation period segment of the contract period so that it can reconcile discrepancies in the total charged amount versus the total applicable amount for the contract period.

This calculation method supports two variants:

-

The per day amount is computed and is then multiplied by the number of enrolled days in the calculation period (referred to as Calculation Period Days) - this is referred to as amount distribution Daily

-

The per day amount is multiplied by the number of days in the calculation period within the contract period that are fully enrolled and is divided by the number of fully enrolled calculation period. The premium is thus evenly spread over the calculation period in the contract period. This is referred to as amount distribution Evenly.

The table below explains the calculations when an amount is specified as Yearly.

| Circumstances | Amount Distribution Daily | Amount Distribution Evenly |

|---|---|---|

Full Enrollment |

Daily Amount * # Calculation Period Days |

Daily Amount * # Full Calculation Period Days / # Full Calculation Periods |

Partial Enrollment |

Daily Amount * # Actual Enrolled Days |

|

Last CPS (Calculation Period Segment) |

Daily Amount * # Contracted Enrolled Days - Charged Value |

|

The Daily amount is the configured amount value divided by the number of days in the year (365 or 366 as specified in the first section of this document).

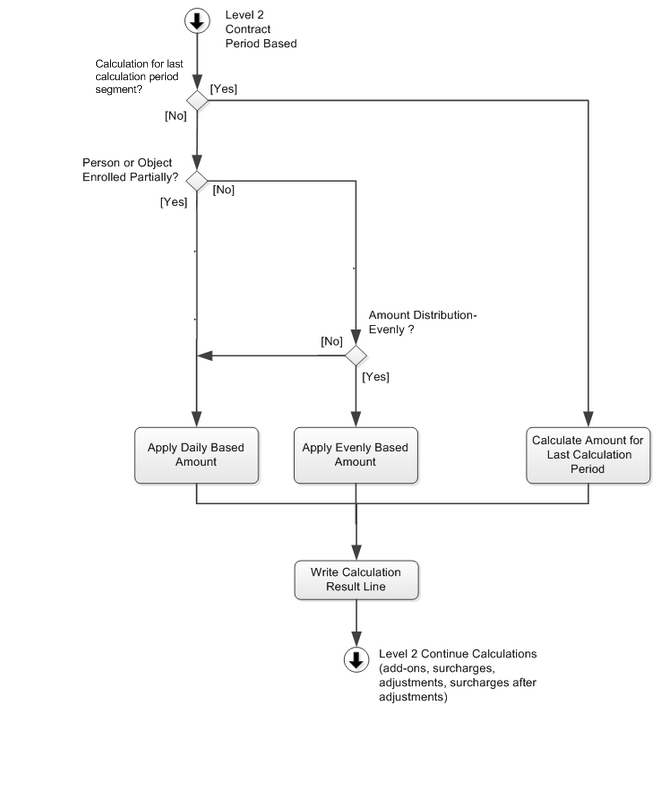

The first step in the calculation process is to identify if the calculation period segment for which the calculations are intended is the last calculation period segment in the contract period or not. The system detects that the calculation period segment is the last calculation period segment for enrollment product premium, adjustment and surcharge calculation by the following logic:

-

If the policy enrollment product ends before the end of the contract period, the last calculation period segment is the one during which the policy enrollment product ends.

-

If the policy enrollment product does not end during the contract period, the last calculation period segment is the period that starts in the contract period and ends on or after the last day of the contract period.

For the add-on, the system checks the end date of the policy add-on instead of the policy enrollment product. If the calculation period segment is identified as the last calculation period segment, the calculation, as mentioned in the section 'Calculations for the Last Calculation Period Segment' is performed.

If the calculation period segment is not the last calculation period segment, the system performs checks to determine if the enrollment is partial or full for the policy enrollment product (or add-on for add-on premium). If the enrollment is partial then the system charges the value (and surcharges and adjustments) only for the days that the person or objects is enrolled irrespective of the partial period resolution setting on the enrollment product. The amount is computed by multiplying the daily amount by the actual number of days the person or object is enrolled. Now, If the enrollment is for the fully enrolled then the system checks for the applicable calculation variant (Daily or Evenly) which is given by the amount distribution setting on the enrollment product, group account product, group account or group client. Based on this setting, the system then charges either the daily based or evenly based amount for the calculation period segment.

Calculation for the Last Calculation Period Segment

The system calculates the total applicable amount for the full enrolled contract period by deriving the daily amount and then multiplying it by the number of enrolled days.

Next, the system retrieves all past calculation results within the contract period of the calculation period segment in context, to determine what has already been charged. Finally, the system determines the amount, for the last calculation period segment, such that the aggregated result of all calculations in the contracted period equals the total applicable amount.

The amount for the last calculation period segment is given by Daily Amount * Contracted Enrolled Days - Charged Value wherein the 'Daily Amount * Contracted Enrolled Days' is the sum of daily premium up to and including the Last Calculation Period Segment and the 'Charged Value' is the sum of all the calculated premiums up to and including the Last Calculation Period Segment.

Note that the Last calculation period period segment is referred to as Last CPS when the enrollment is fully enrolled for the calculation period.

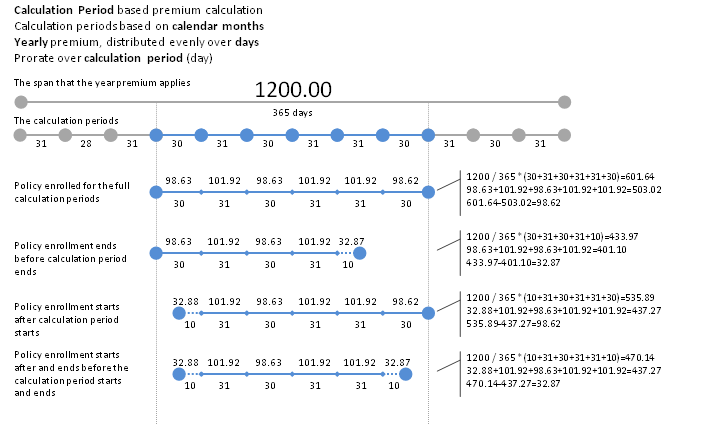

Amount Distribution Daily

The image below explains this method of calculation.

Configurations

The default time periods are defined as:

| Default Time Periods | ||

|---|---|---|

2017 - 1 |

1/1/2017 |

30/6/2017 |

2017 - 2 |

1/7/2017 |

31/12/2017 |

2018 - 1 |

1/1/2018 |

30/6/2018 |

2018 - 2 |

1/7/2018 |

31/12/2018 |

The calculation periods are defined as:

| Alias | Start Date | End Date | CP Reference Date |

|---|---|---|---|

Jan'17 |

1/1/2017 |

31/1/2017 |

1/1/2017 |

Feb'17 |

1/2/2017 |

28/2/2017 |

1/2/2017 |

… |

… |

… |

… |

Dec'18 |

1/12/2018 |

31/12/2018 |

1/12/2018 |

… |

The premium schedule lines that are associated to BASIC PLAN are defined as:

| Premium Schedule Lines - BASIC PLAN | ||||

|---|---|---|---|---|

Default Time Period |

Age From |

Age To |

Gender |

Premium |

2017 - 1 |

- |

- |

- |

1200 |

2017 - 2 |

- |

- |

- |

1200 |

2018 - 1 |

- |

- |

- |

1300 |

2018 - 2 |

- |

- |

- |

1300 |

| Premium Schedule Lines - COPAY PLAN | ||||

|---|---|---|---|---|

Default Time Period |

Age From |

Age To |

Gender |

Premium |

2017 - 1 |

0 |

49 |

- |

1300 |

2017 - 1 |

50 |

150 |

- |

1500 |

2017 - 2 |

0 |

49 |

- |

1300 |

2017 - 2 |

50 |

150 |

- |

1500 |

2018 - 1 |

- |

- |

- |

1300 |

2018 - 2 |

- |

- |

- |

1300 |

| All the examples for this method will refer to this configuration. |

Suppose that a policy with the following contract period exists

| Contract Period Start Date | Contract Period End Date | Contact Period Reference Date |

|---|---|---|

1/6/2017 |

31/5/2018. |

1/6/2017 |

Enrollment Product |

Policy Enrollment Product Start Date |

Policy Enrollment Product End Date |

BASIC PLAN |

1/6/2017 |

The value for premium, adjustment and surcharge is referenced as of the contract reference date for the contract period and is applicable for the entire contract period. For the reference date of 1/6/2017, the default time period that is selected is 2017 -1 and, therefore, the applicable premium for all the CPSs within the contract period is 1200.00

Calculations

The calculation for the Policy Enrollment Product will be as follows

| Each calculation period below will be identified as a single calculation period segment during the premium calculation process |

| Calculation Period | Premium | Calculation |

|---|---|---|

June'17 |

98.63 |

1200/365 * (30) |

July'17 |

101.92 |

1200/365 * (31) |

Aug'17 |

101.92 |

1200/365 * (31) |

Sep'17 |

98.63 |

1200/365 * (30) |

Oct'17 |

101.92 |

1200/365 * (31) |

Nov'17 |

98.63 |

1200/365 * (30) |

Dec'17 |

101.92 |

1200/365 * (31) |

Jan'18 |

101.92 |

1200/365 * (31) |

Feb'18 |

95.34 |

1200/365 * (29) |

Mar'18 |

101.92 |

1200/365 * (31) |

Apr'18 |

98.63 |

1200/365 * (30) |

May'18 (Last CP) |

98.62 |

1200/365 * (365) - 1101.38 |

The amount for each Calculation Period Segment for which the Policy Enrollment Product is enrolled over the full Calculation Period is calculated based on the number of days in the calculation period

June'17 = 1200/365 * (30)

July'17 = 1200/365 * (31) and so on.

The policy enrollment product does not end during the contract period, and, therefore, the last calculation period is the period in which the contract period ends

The calculation for the last Calculation Period May'18 is Daily Amount * Contracted Enrolled Days - Charged Value

In this case the Daily Amount * Contracted Enrolled Days = 1200/365 * (365)

Charged Value is the sum of all the charged premiums up to the Last CP = 1101.38

So the value for May'18 = 1200/365 * (365) - 1101.38 = 98.62.

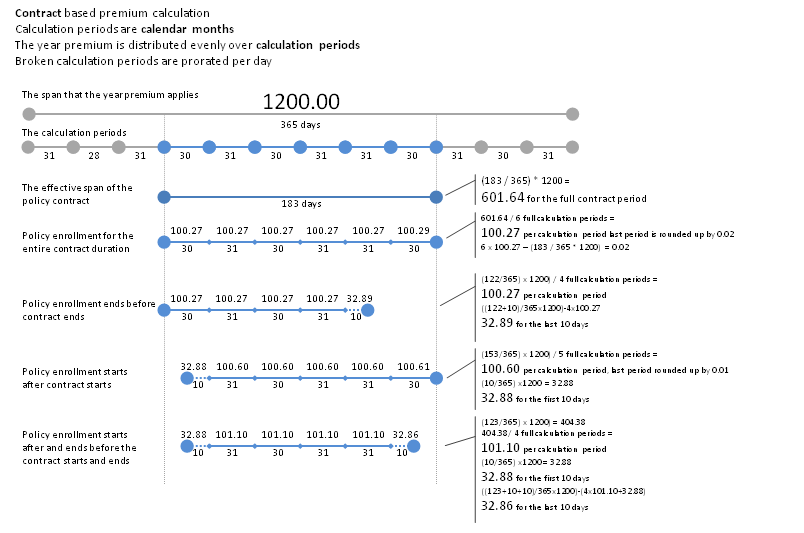

Amount Distribution Evenly

In the situation above, the premium is calculated daily and that’s why every CPS has a different amount. Alternatively, the system can distribute the premium amount evenly across the calculation period - so that the same amount is charged every month - while still aggregating to the same total premium for the entire contracted period. The premium calculations for the year 2017 that apply to the policy when premium is distributed evenly is as shown in the image below.

The point to note is that the premium computation will change if the contract period includes the 29th of February as that is a leap year and will have 366 days.

Reconsider the above example of policy contract with the amount distribution now as Evenly.

| Each calculation period below will be identified as a single calculation period segment during the premium calculation process. |

| Calculation Period | Premium | Calculation |

|---|---|---|

April'17 |

100.27 |

((1200/365)*183)/6 |

May'17 |

100.27 |

((1200/365)*183)/6 |

June'17 |

100.27 |

((1200/365)*183)/6 |

July'17 |

100.27 |

((1200/365)*183)/6 |

Aug'17 |

100.27 |

((1200/365)*183)/6 |

Sep'17 (Last CP) |

100.29 |

((1200/365)*183 - 501.35 |

The amount for each full Calculation Period is calculated based on the number of days in the full Calculation Periods and number of the full Calculation Periods within the contract period = Daily Amount * Full Calculation Period Days / Full Calculation Periods The Daily Amount = Configured Value / No of days in the calendar year = (1200/365). Therefore the amount for each full Calculation Period = ((1200/365)*183)/6 = 100.27

The amount for the last Calculation Period Sep'17 is Daily Amount * Contracted Enrolled Days _ (1200/365)*(183) - _ Charged Value = 100.29

Amount Recalculation

The amount recalculation for a calculation period segment might be required because of a change to the person or object or policy. Thesystem determines which past calculation period segments are part of the recalculation process based on the input parameter look back date of the calculated premium activity and the effective date setting on the mutation event (created because of the change). Depending on these configuration, the past calculation period segments are either recalculated or not.

It is possible that the change in the system which resulted in the mutation impacts the calculations of the past calculation period segments, but because of the mentioned configurations these calculation period segments are not recalculated. However, in this method the configured amount applies for the contracted period and, therefore, the charged amount for the contracted period must aggregate to the applicable amount. This requires the system to carry out reconciliation calculations in the last calculation period segment of the contract period.

Consider a scenario of policy enrollment product termination to understand this.

| Each calculation period below will be identified as a single calculation period segment during the premium calculation process. |

A policy with a policy enrollment product from 1/1/2017 to 31/12/2017 has an applicable premium of 1200.00 yearly to be distributed evenly. Suppose the collection frequency is set to 12 Calculation Periods, then the premium calculation batch when executed with the input Calculation Period of Jan'17, will result into the following calculations:

| CP | Premium | Calculations |

|---|---|---|

Jan'17 |

100 |

1200/365*(365/12) |

Feb'17 |

100 |

1200/365*(365/12) |

Mar'17 |

100 |

1200/365*(365/12) |

April'17 |

100 |

1200/365*(365/12) |

May'17 |

100 |

1200/365*(365/12) |

June'17 |

100 |

1200/365*(365/12) |

July'17 |

100 |

1200/365*(365/12) |

Aug'17 |

100 |

1200/365*(365/12) |

Sep'17 |

100 |

1200/365*(365/12) |

Oct'17 |

100 |

1200/365*(365/12) |

Nov'17 |

100 |

1200/365*(365/12) |

Dec'17 (Last CP) |

100 |

1200/365*(365) -1100 |

Now suppose that the policy enrollment product is terminated on 5/7/2017.

In order to evenly spread the amount over the contracted periods, the system looks forward (and backward) to count the number of fully enrolled calculation period segment within the contract. Now, when the enrollment is terminated half-way through the contracted period, this number changes. This means that if the system recalculates the past periods that the policy was fully enrolled, it will come up with a different premium amount, even though nothing changed during those past periods.

The last calculation period takes into account which calculation periods are recalculated or not and thus ensures that the charged amount aggregates to the applicable amount.

Because the calculation periods that are selected for recalculations are based on the look back date and mutation effective date, various situations are possible. Some possible situations are described below to illustrate the effect of recalculations on the last calculation period.

Situation 1: The policy mutation having an effective date of 5/7/2017 and the premium calculation batch executed with a look back date of 1/1/2017, results into the recalculation of the calculation period July'17.

| Calculation Period | Premium | Calculations |

|---|---|---|

July'17 (Last CP) |

11.51 |

1200/365*(186) - 600 |

Situation 2: The policy mutation having an effective date of 1/1/2017 and the premium calculation batch executed with a look back date of 1/4/2017, results into the recalculation of the calculation periods April'17 up to July'17

| Calculation Period | Premium | Calculations |

|---|---|---|

April'17 |

99.18 |

1200/365 *(181/6) |

May'17 |

99.18 |

|

June'17 |

99.18 |

|

July'17 |

13.97 |

100+100+100+99.18+99.18+99.18 =597.54 |

Situation 3: The look back date and mutation effective date are supposed to be 1/1/2017, then all the periods from Jan'17 onward will be part of the recalculation process and will be recalculated as

| Calculation Period | Premium | Calculations |

|---|---|---|

Jan'17 |

99.18 |

1200/365*(181/6) |

Feb'17 |

99.18 |

1200/365*(181/6) |

Mar'17 |

99.18 |

1200/365*(181/6) |

April'17 |

99.18 |

1200/365*(181/6) |

May'17 |

99.18 |

1200/365*(181/6) |

June'17 |

99.18 |

1200/365*(181/6) |

July'17 (Last CP) |

16.43 |

99.18+99.18+99.18+99.18+99.18+99.18 = 595.08 |