Scenario A

This scenario explains premium calculation for a policy without a group account or contract period. The policy has one policy enrollment product. The premium calculation in this scenario uses system calculation periods.

Policy 2340

Policy Code |

POL2340 |

Group Account |

- |

Contract Period |

- |

Collection Frequency |

1 [1] |

Member |

W. Wright |

Enrollment Product |

BASIC PLAN with start date 01-Jan-2015 |

The premium calculation process for the policy starts by identifying the calculation periods. The look back date is 1-Jan-2014, therefore, all the calculation periods before the input calculation period and up to the calculation period to which 1-Jan-2014 belongs are considered for premium calculation. The advance collection setting is 1 Month, therefore no calculation period after the calculation period Jan'15 is considered.

The next step is to verify the calculation periods Since the policy enrollment started on 1-Jan-2015 (so Jan 15 is in fact the first calculation for this policy) , there are no past periods that require recalculation.

The calculations are performed for the person W. Wright for the enrollment product BASIC PLAN.

Calculations for Jan'15

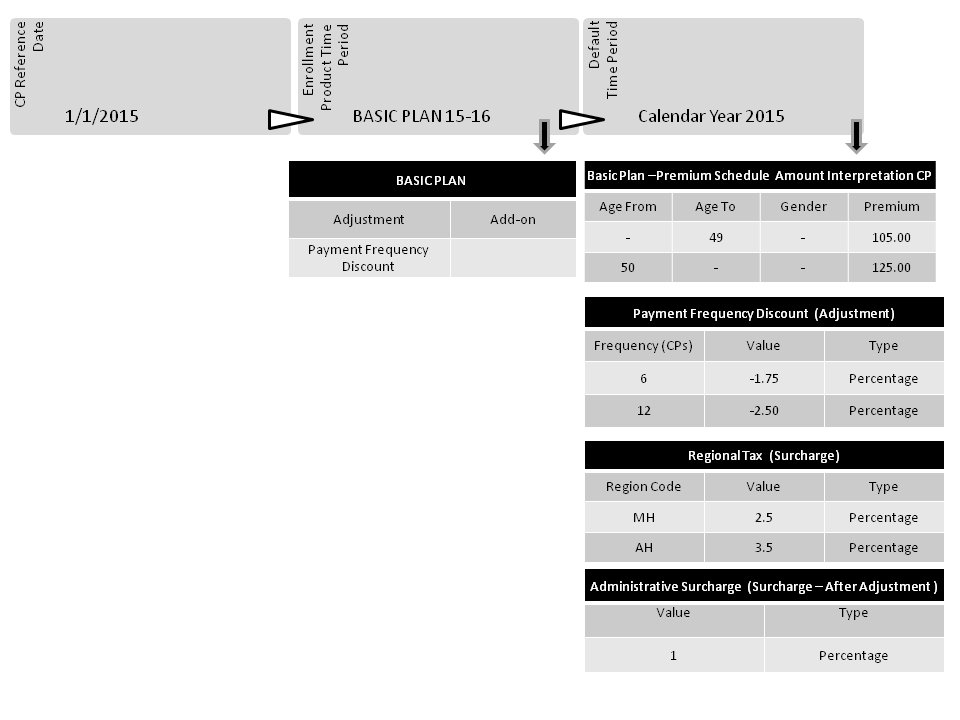

The system considers the reference date setting on the calculation period as the reference date for the calculations i.e. 1-Jan-2015. Once the reference date for the calculation period is selected the next step is to select the time periods. In this case, the reference date belongs to BASIC PLAN 15-16, therefore, the enrollment product time period - BASIC PLAN 15-16 is selected. The enrollment product time period drives the selection of the default time period. The start date of the enrollment product time period 1-Jan-2015 belongs to Calendar Year 2015. The Calendar Year 2015 is therefore selected as the applicable default time period.

The image below provides a snapshot of the configurations that are applicable for the calculations.

Enrollment Product Premium

The system identifies the calculation method to be applied as 'Calculation Period Based' as the premium schedule is defined to have amount interpretation as 'Calculation Period'. Now, the person is enrolled for the full calculation period and, therefore, the configured value on the evaluated schedule line is charged as premium.

Premium Schedule line evaluation

The premium schedule lines applicable within the selected default time period are considered (see the image above). The premium schedule lines are based on the dynamic dimensions of Age. Therefore, as per person’s age the premium is applied. The person’s birth date is 4-May-1965, thus as of the calculation period Jan'15 his age is 49 years (referenced as of 1-Jan-2015). The premium schedule line with the age range 0-49 is therefore selected and the premium amount of 105.00 is charged for this calculation period.

Base Premium

The base premium for the subsequent calculations (surcharges and adjustments) is 105.00 as no add-ons are configured for the person.

Surcharges

Once the premium is calculated, the surcharges are applied. In the sample configuration, a tax based on the members 'region' - a dynamic field on relation - is configured.

In order to evaluate a dynamic field based dimension, the value on the surcharge rule must be compared to the value of the dynamic field. Because the dynamic field is on the entity 'Relations', the value is evaluated for the person that is enrolled as the person for the enrollment product, that is, W. Wright. Suppose that the person’s region code is MH, then for the selected default time period a surcharge of 2.5% is applicable.

Surcharge amount = 2.5% of 105.00 = 2.63

Adjustments

Two adjustment types are configured in the system: Payment Frequency Discount and Office Visit Co-payment Discount. As per the enrollment product configurations, the Payment Frequency Discount is the only applicable adjustment for the enrollment product BASIC PLAN on the reference date.

The Payment Frequency Discount is based on the dimension of the type 'Generic' - the advance collection setting setting on the policy. Therefore, a dynamic logic condition is used to evaluate the adjustment rules. Here, no adjustment rules are applicable, as there are no rules defined with the schedule dimension value of 1 which would match the advance collection setting on the policy. This adjustment is thus not applied.

Surcharges - After Adjustment

Post adjustment surcharge is computed after adding the adjustment to the base premium (or subtracting it if it is negative). A post adjustment 'Administrative Surcharge' of 1% is applicable.

Administrative Surcharge = 1% on (total charged premium + adjustments) = 1% (105.00 + 0.00) = 1.05

Calculation Results for Jan'15

Calculation Result Lines

The calculation result lines for W. Wright for BASIC PLAN calculation period Jan'15 are:

| Start Date | End Date | Input Amount | % | Prorate Factor | Result Amount | Schedule Definition | Premium Schedule |

|---|---|---|---|---|---|---|---|

1-Jan-2015 |

31-Jan-2015 |

- |

- |

- |

105.00 |

Age Gender Premium |

Basic Plan |

1-Jan-2015 |

31-Jan-2015 |

105.00 |

2.5% |

- |

2.63 |

Regional Tax |

|

1-Jan-2015 |

31-Jan-2015 |

105.00 |

1 |

- |

1.05 |

Admin. Surcharge |

Calculation Result

| Policy | Calculation Period | Total Base Premium | Total Adjustment | Total Surcharge | Total Result |

|---|---|---|---|---|---|

POL2340 |

1-Jan-2015 |

105.00 |

0.00 |

3.68 |

108.68 |

Calculations from Feb'15 up to Dec'15

The reference date changes with each calculation period, therefore there is a possibility that the applicable configurations may also change.

Consider the premium calculations for the calculation period of June'15. In June'15 the reference date is 1-Jun-2015, and the person’s age will be 50 years when computed as of 1-Jun-2015. This will result in the change of the applicable premium. The new value will get applied starting June'15 and it will be 125.00.

The base premium calculations for the calculation periods from Feb'15 to Dec'15 will be as under:

| Calculation Period | Premium | Calculations |

|---|---|---|

Feb'15 |

105.00 |

Configured amount as per evaluated premium schedule line (Age 49) |

Mar'15 |

105.00 |

|

April'15 |

105.00 |

|

May'15 |

105.00 |

|

June'15 |

125.00 |

Configured amount as per evaluated premium schedule line (Age 50) |

July'15 |

125.00 |

|

Aug'15 |

125.00 |

|

Sep'15 |

125.00 |

|

Oct'15 |

125.00 |

|

Nov'15 |

125.00 |

|

Dec'15 |

125.00 |

Regional Tax

Suppose that the person’s residence region does not change within the year 2015, the applicable Regional Tax surcharge for all the calculation period will be 2.5% however since the base premium changes from June'15 onward, the charged amount also changes.

| Calculation Period | Regional Tax | Calculations |

|---|---|---|

Feb'15 |

2.63 |

2.5% of 105.00 |

Mar'15 |

2.63 |

|

April'15 |

2.63 |

|

May'15 |

2.63 |

|

June'15 |

3.13 |

2.5% of 125.00 |

July'15 |

3.13 |

|

Aug'15 |

3.13 |

|

Sep'15 |

3.13 |

|

Oct'15 |

3.13 |

|

Nov'15 |

3.13 |

|

Dec'15 |

3.13 |

Payment Frequency Discount

For all the calculation periods, the selected enrollment product time period is BASIC PLAN 15-16 and, therefore, the Payment Frequency Discount adjustment is applicable for all the calculation periods. The adjustment rules that are considered for the evaluation are the ones that belong to the selected default time period and are mentioned below:

| Year | Advance Collection Setting | Discount | Type |

|---|---|---|---|

Calendar Year 2015 |

6 |

-1.75 |

Amount |

12 |

-2.50 |

Amount |

As the advance collection setting is 1 Month, no frequency discount gets applied for any of the calculation periods.

Administrative Surcharge

1% of administrative surcharge is applicable for all the calculation periods and will be changed as mentioned below

| Calculation Period | Administrative Surcharge | Calculations |

|---|---|---|

Feb'15 |

1.05 |

1% of 105.00 |

Mar'15 |

1.05 |

|

April'15 |

1.05 |

|

May'15 |

1.05 |

|

June'15 |

1.25 |

1% of 125.00 |

July'15 |

1.25 |

|

Aug'15 |

1.25 |

|

Sep'15 |

1.25 |

|

Oct'15 |

1.25 |

|

Nov'15 |

1.25 |

|

Dec'15 |

1.25 |