Scenario C

The calculations in this scenario are for a policy with a group account.

Policy 2342

Policy Code |

POL2342 |

Group Account |

ORCL with start date 01-Jan-2015 |

Contract Period |

- |

Collection Frequency |

12 [1] |

Member 1 |

L. Jones |

Enrollment Product |

BASIC PLAN with start date 01-Jan-2015 and end date 15-Dec-2015 |

Member 2 |

S. Jones |

Enrollment Product |

SILVER PLAN with start date 01-Jan-2015 |

The policy enrollment details are similar between Scenario B and Scenario C. In both the scenarios B and C there are two policy enrollments and they are for the basic and silver plan respectively. However, the calculations for the policy in this scenario are different from scenario B because:

-

The default and enrollment product time periods are driven by the group account time period

-

The add-on override value and override values for adjustment rules on the group account level are selected if available and applied.

-

The persons data (age, region code) are different.

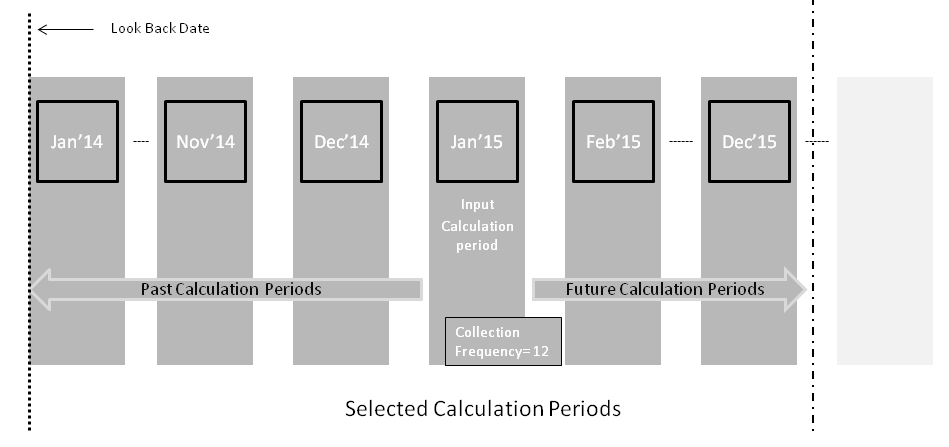

Select and Verify Calculation Periods

Here the advance collection setting is 12 Months, therefore, all the calculation periods from the calculation period to which the look back date belongs to up to the last calculation period in the collection cycle are selected.

Since the policy enrollment started on 1-Jan-2015 (so Jan 15 is in fact the first calculation for this policy), there are no past periods that require recalculation. Therefore calculation periods from Jan'15 to Dec'15 are only considered for the calculations.

Calculation BASIC PLAN

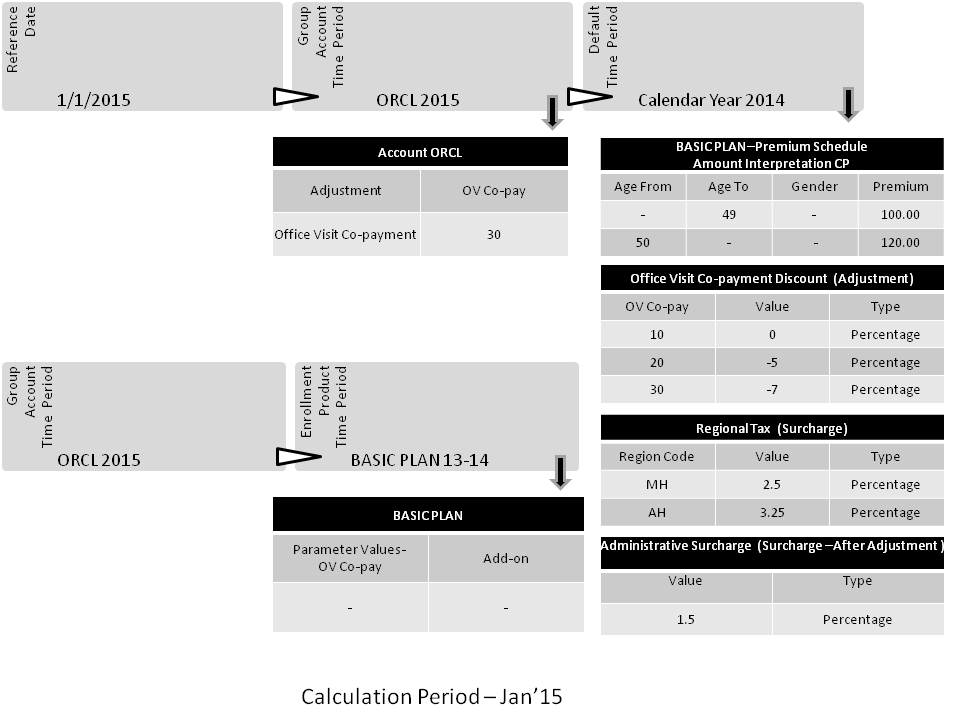

The configuration that gets applied for BASIC PLAN for L.Jones for the calculation period of Jan'15 is as shown in the image below:

Calculation Period Jan'15

The calculation period reference date is considered as the reference date for the calculations that is 1-Jan-2015. Once the reference date for the calculation period is selected the next step is to select the time periods. In this case, the reference date belongs to ORCL 2015, therefore, the group account time period ORCL 2015 is selected. The group account time period drives the selection of the default time period and enrollment product time periods. The start date of the group account time period 1-Jun-2014 belongs to Calendar Year 2014 and BASIC PLAN 13-14. Thus Calendar Year 2014 and BASIC PLAN 13-14 are selected as default time period and enrollment product time period respectively.

Enrollment Product Premium

The premium calculation for the enrollment product BASIC PLAN for L. Jones is based on the method 'Calculation Period Based' as the premium amount Interpretation setting is 'Calculation Period'.

The premium schedule lines are based on the dimension Age. L. Jones’s age as of 1-Jan-2015 is 19 years and, therefore, the premium value of 100.00 applies.

The base premium is 100.00 as no policy add-ons are configured

Surcharges

A Regional Tax surcharge of 3.25% is applicable for this policy enrollment product on the base premium i.e. 3.25% on 100.00 = 3.25

Adjustments

The Office Visit Co-payment Discount adjustment is configured for group account ORCL. This adjustment is based on OV Co-pay parameter. Now, a parameter value of 30 is defined on the policy enrollment product and thus the applicable adjustment rule is.

| OV Co-Pay | Discount | Type |

|---|---|---|

30 |

-7 |

Percentage |

The system checks for the group account specific value for this adjustment rule within ORCL 2015 time period. However, no override value for the rule is specified at the group account level and thus the adjustment value of -7% applies.

Adjustment = -7% on 100.00 = -7.00

Surcharges - After Adjustment

The post adjustment Administrative Surcharge of 1.5% applies on the base premium plus adjustments i.e 1.5% on (100.00 - 7.00) = 1.40

Calculation Result Lines for Basic Plan Jan'15

| Start Date | End Date | Input Amount | % | Prorate Factor | Result Amount | Schedule Definition | Premium Schedule |

|---|---|---|---|---|---|---|---|

01/01/15 |

31-Jan-2015 |

- |

- |

- |

100.00 |

Age Gender Premium |

Basic Plan |

01/01/15 |

31-Jan-2015 |

100.00 |

3.25 |

- |

3.25 |

Regional Tax |

|

01/01/15 |

31-Jan-2015 |

100.00 |

-7 |

- |

-7.00 |

Office Visit Co-payment Discount |

|

01/01/15 |

31-Jan-2015 |

93.00 |

1.5 |

- |

1.40 |

Admin. Surcharge |

The above calculation applies from Feb'15 to May'15. But from the calculation period June'16 onward the calculation changes as the applicable group account time period changed from ORCL-2015 to ORCL-2016.

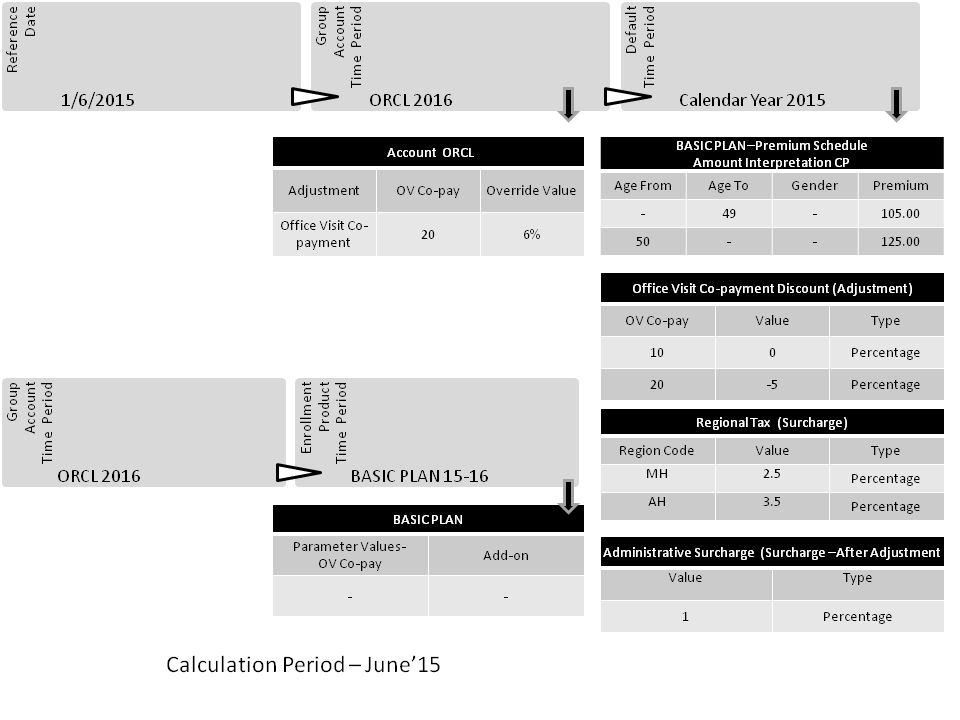

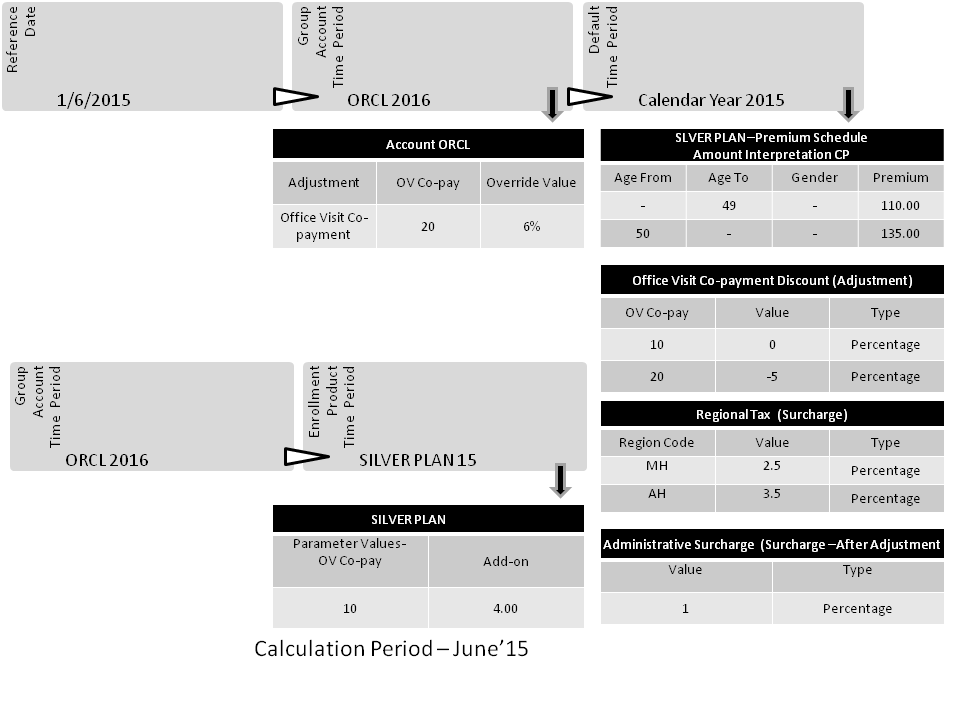

Calculation Period June'15

The image below depicts the configuration that applies for L. Jones of June'16

Enrollment Product Premium

Since the default time period changes, the applicable premium amount now changes from 100.00 to 105.00

Surcharges

The region code value 'AH' is applicable to the person and thus the surcharge value of 3.5% gets selected.

Regional Tax surcharge = 3.5% on 105.00 = 3.68

Adjustment

The adjustment rule with OV Co-pay value of 20 applies. An override adjustment value of 6% is specified at the group account level for this rule, therefore, the system applies an adjustment value of 6% on base premium.

Office Visit Co-payment Discount adjustment = -6% on 105.00 = -6.30

Surcharges - After Adjustment

The post adjustment Administrative Surcharge of 1% applies on the value given by base premium plus adjustments.

Administrative Surcharge = 1% on (105.00-6.30) = 0.99

Calculation Result Lines for Basic Plan June '15

| Start Date | End Date | Input Amount | % | Prorate Factor | Result Amount | Enroll. Product | Schedule Definition | Premium Schedule |

|---|---|---|---|---|---|---|---|---|

1-Jan-2015 |

31-Jan-2015 |

- |

- |

- |

105.00 |

BASIC PLAN |

Age Gender Premium |

Basic Plan |

1-Jan-2015 |

31-Jan-2015 |

105.00 |

3.5 |

- |

3.68 |

BASIC PLAN |

Regional Tax |

|

1-Jan-2015 |

31-Jan-2015 |

105.00 |

-6 |

- |

-6.30 |

BASIC PLAN |

Office Visit Co-payment Discount |

|

1-Jan-2015 |

31-Jan-2015 |

98.70 |

1 |

- |

0.99 |

BASIC PLAN |

Admin. Surcharge |

The above calculation applies from June'15 to Nov'15.

Calculation for partial enrollment applies for Dec'15 as L. Jones terminates the enrollment halfway through during this period. The partial period resolution for BASIC PLAN is 'Per Day'; this implies that the person is charged only for the days that the person is enrolled during the calculation period.

Calculation Period Dec '15

Enrollment Product Premium

The premium amount that gets applied for the calculation period is reduced by the prorate factor. The premium is charged only for the number of days the person is enrolled.

Premium amount = 105.00 * 15/31 = 50.81

Surcharges - After Adjustment

The post adjustment Administrative Surcharge of 1% applies on the value given by base premium plus adjustments.

Administrative Surcharge = 1% (50.81-3.05) = 0.48

Calculation Result Lines for Basic Plan Dec '15

| Start Date | End Date | Input Amount | % | Prorate Factor | Result Amount | Schedule Definition | Premium Schedule |

|---|---|---|---|---|---|---|---|

01/12/15 |

15/12/15 |

105.00 |

- |

15/31 |

50.81 |

Age Gender Premium |

Basic Plan |

01/12/15 |

15/12/15 |

50.81 |

3.5 |

- |

1.78 |

Regional Tax |

|

01/12/15 |

15/12/15 |

50.81 |

-7 |

- |

-3.05 |

Office Visit Co-payment Discount |

|

01/12/15 |

15/12/15 |

47.76 |

1.5 |

- |

0.48 |

Admin. Surcharge |

Calculations for SILVER PLAN

In scenario B, the selected default time period for the SILVER PLAN is different from the BASIC PLAN. Also, the SILVER PLAN has different adjustment types and add-ons configured within the selected enrollment product time period and different parameter values on the policy enrollment product. This results in the applicable adjustment types, adjustment rules and surcharge rules being different for the SILVER PLAN in comparison to the BASIC PLAN.

In this case, for a given calculation period the selected default time period remains the same for both the enrollment products. This is because it is derived based on the group account time period and not the enrollment product time period. Also, the adjustment types configured on the group account level apply to both the enrollment products. Therefore, for a calculation period the adjustment types, adjustment rules and surcharge rules that apply for both the enrollment product are the same.

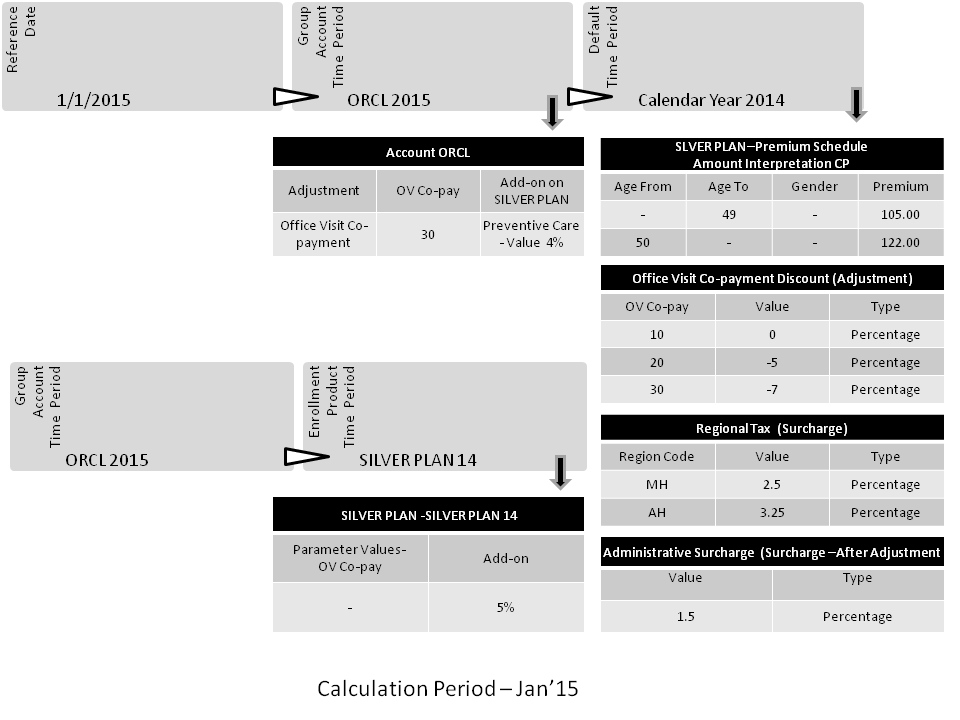

Calculation Period Jan'15

The image below shows the configuration that applies for the enrollment product 'SILVER PLAN' for S. Jones during the premium calculation for the calculation period Jan'15.

Enrollment Product Premium

The premium calculation for the enrollment product SILVER PLAN for S. Jones is based on the method 'Calculation Period Based' as the premium amount Interpretation setting is 'Calculation Period'. The premium schedule lines are based on the dimension Age. S. Jones age as of 1-Jan-2015 is 21 years and, therefore, the premium value of 105.00 applies.

The system only considers add-on premium schedules that apply to the enrollment product time period. In this case, it is the add-on premium schedule for the Preventive Care add-on that has one add-on premium schedule line that specifies 5%. Before applying this value, the system will try to find an overriding value on the group account product level for the applicable group account time period. If an overriding value is found, it is used instead of the value specified on the enrollment product level. Here, the add-on value of 4% is specified at the group account level and thus add-on premium is 4% of 105.00.

Base Premium = 105.00 + 4% on 105.00 = 109.20

Surcharges

Regional Tax = 3.25% on 109.20 = 3.55 (this tax is distributed across the product premium and add-on premium, so two separate calculation result lines are created).

Adjustments

The adjustment scope is set to Total Premium so the adjustment is applied to the product premium and the add-on premium.

Office Visit Co-payment Discount adjustment = -7% on 109.20 = -7.64

Surcharges - After Adjustment

The post adjustment Administrative Surcharge of 1.5% applies on the value given by base premium plus adjustments.The post adjustment Administrative Surcharge = 1.5% on (109.20-7.64) =1.52

Calculation Result Lines for Jan'15

| Start Date | End Date | Input Amount | % | Prorate Factor | Result Amount | Enroll. Product | Add-on | Schedule Definition | Premium Schedule |

|---|---|---|---|---|---|---|---|---|---|

1-Jan-2015 |

31-Jan-2015 |

- |

- |

- |

105.00 |

SILVER PLAN |

Age Gender Premium |

Silver Plan |

|

1-Jan-2015 |

31-Jan-2015 |

105.00 |

3.25 |

- |

3.41 |

SILVER PLAN |

Regional Tax |

||

1-Jan-2015 |

31-Jan-2015 |

105.00 |

4 |

- |

4.20 |

SILVER PLAN |

Preventive Care |

||

1-Jan-2015 |

31-Jan-2015 |

4.20 |

3.25 |

- |

0.14 |

SILVER PLAN |

Regional Tax |

||

1-Jan-2015 |

31-Jan-2015 |

109.20 |

-7 |

- |

-7.64 |

SILVER PLAN |

Office Visit Co-payment |

||

1-Jan-2015 |

31-Jan-2015 |

101.56 |

1.5 |

- |

1.52 |

SILVER PLAN |

Admin. Surcharge |

The above calculation applies from Feb'15 to Dec'15.

Calculation Period June'15

The image below shows the configuration that gets applied for the calculation period June'15

From the calculation period June'16 onward the applicable group account time period changed from ORCL-2015 to ORCL-16. This results in the selection of different default time period and therefore applicable premiums, adjustments and surcharges also change.

| Start Date | End Date | Input Amount | % | Prorate Factor | Result Amount | Add-on | Schedule Definition | Premium Schedule |

|---|---|---|---|---|---|---|---|---|

1-Jun-2015 |

30-Jun-2015 |

- |

- |

- |

110.00 |

Age Gender Premium |

Silver Plan |

|

1-Jun-2015 |

30-Jun-2015 |

110.00 |

3.5 |

- |

3.85 |

Regional Tax |

||

1-Jun-2015 |

30-Jun-2015 |

- |

- |

- |

4.00 |

Preventive Care |

||

1-Jun-2015 |

30-Jun-2015 |

4.00 |

3.5 |

- |

0.14 |

Regional Tax |

||

1-Jun-2015 |

30-Jun-2015 |

114.00 |

-6 |

- |

-6.84 |

Office Visit Co-payment |

||

1-Jun-2015 |

30-Jun-2015 |

107.16 |

1 |

- |

1.07 |

Admin. Surcharge |

The above calculation applies from June'15 to Dec'15.