The refund for a return is issued in the form of store credit or credit to the customer’s credit card, or a combination of the two. The form of the refund is based on the original payment method, and cannot be selected by the customer. If the customer used only store credit to purchase the order, the refund is in the form of a store credit; if the customer used only a credit card to purchase the order, the refund is in the form of a credit to that credit card.

If the customer purchased the order using a combination of store credit and a credit card, the refund is first applied to the credit card, up to the amount originally charged to the credit card; any remaining amount is then refunded as store credit. For example, suppose the original order total was $100, with $60 charged to a credit card and $40 paid through store credit. If the customer returns items totaling $50, the entire refund is applied to the credit card. However, if the customer returns items totaling $70, a $60 credit is applied to the credit card and the remaining $10 credit is refunded as store credit.

Note that this logic applies even if there are multiple returns associated with an order. In this example, if items totaling $50 are returned, the entire refund is applied to the credit card. But if further items totaling $15 are later returned, only a $10 credit is then applied to the credit card, and the remaining $5 credit is refunded as store credit. In other words, the first $60 refunded on the order is applied to the credit card, but after that all refunds are store credit, because the portion refunded to the credit card cannot exceed the amount originally charged to the card. If, later on, the rest of the order (totaling $35) is returned, that entire refund is store credit.

Calculating the Refund

Refunds are always issued in the currency of the original order. Refund calculations take into account the pricing of the original order, plus any pricing changes arising from the return or from any previous returns on the order. For example, a return may invalidate a promotion that was applied to the original order.

When the customer clicks the Return Selected Items button or the Return All Items button on the returnItemsSelection.jsp page, the refund is calculated by the calculateRefundAmounts pipeline chain of the Commerce processor pipeline. The various amounts that are added up to determine the total refund (item costs, shipping, taxes, price adjustments, etc.) are stored in the ReturnRequest object.

The confirmReturn.jsp page is then displayed. This page includes the store.war/myaccount/gadgets/refundSummary.jsp gadget, which accesses the ReturnRequest object to display the refund values. For example, to display the taxes refunded:

<dsp:param name="price" value="${returnRequest.actualTaxRefund}"/>If any pricing adjustments are applied, confirmReturn.jsp includes a note below the refund summary:

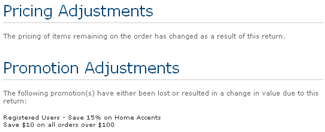

Clicking on the note opens a popup window, store.war/myaccount/gadgets/returnPromotionAmendmentsPopup.jsp, that displays information about the adjustments. For example: